covid-19 news

Update on EaP covid-19 impact

May 2021

The effects of the pandemic varies over the world depending on the pre-existing capacity of each country’s economy to reply to unforeseen events and on its systemic strength. Variables like readiness of the state establishment and institutions, measure of the external support, existing social and financial policies, level of social vulnerabilities, size of the informal market, digital infrastructure play a critical part in deciding the volume of the financial harm. Hence, these factors will decide the speed of the recovery.

There are many differences across sectors as well: within the nations with high reliance on tourism and commodity export, financial affect of the Covid-19 was much extreme. Whereas industrial production has been continuously returning to the pre-Covid-19 level, services requiring physical contact with customers, such as the ones in the hospitality sector, arts and entertainment, brick and mortar retail, continue to operate with limited scope.

The Eastern Partnership countries are no exception: it is expected that the tourism sector will go though the longest way towards recovery. Most retailers and restaurants were closed for a long time and online sales could not compensate for the loss, especially in the regions where digital services are underdeveloped. The decrease in the monthly sales resulted in a drop of revenues causing a higher unemployment rate.

Notwithstanding the slow economic growth trend worldwide, it is still challenging to predict how the future will look like considering the uncertainty around the pandemic.

Read it here.

Update on EaP covid-19 impact

July 2020

The outbreak of the COVID-19 epidemic has caught the world’s attention and the subsequent global crisis has revealed a number of political, economic and societal vulnerabilities whereas the EaP countries have been particularly affected by the far reaching implications of this global pandemic crisis.

A new EU4BCC report has been compiled to offer an up-to-date picture of the situation and impact of the COVID-19 global crisis, as of July 2020, on the EaP countries as a whole and on each of the six countries individually.

The impact of the Covid-19 crisis on public health in the six EU Eastern Partner (EaP) countries so far remains limited compared to Western Europe.

Read it here.

Update on EaP covid-19 impact

March 2020

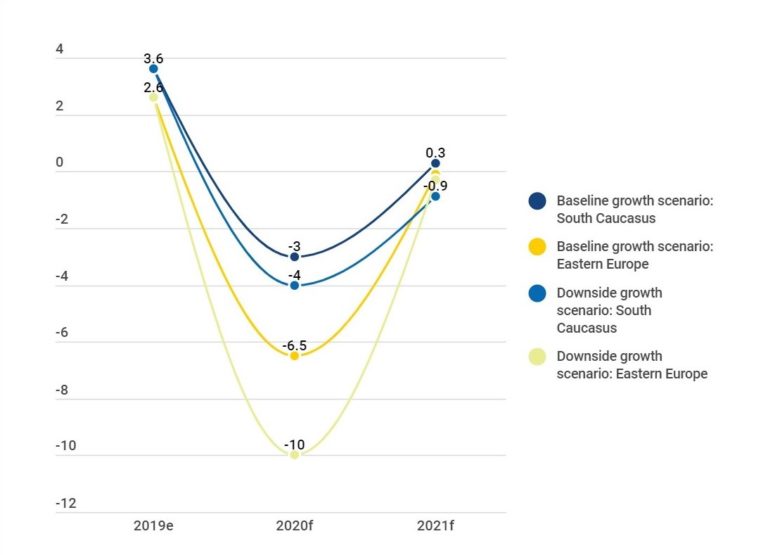

The stringent containment measures to combat the spread of the virus will lead to significant short-term declines in output. One way to estimate the impact of containment measures on GDP is to examine output categories and identify the sectors likely to be most directly affected by such measures.

Several service sectors, such as those related to tourism and proximity services that require direct contact between customers and service providers, will forgo virtually all of their revenues as a result of the restrictions on movement and the requirements of social distancing. Most retailers and restaurants are closed, and increases in their online and take-away sales will not compensate for the resultant massive drop in demand, particularly in places where internet penetration is lower and cyber-commerce less developed. Moreover, non-essential construction work is likely to be adversely affected by limited labour mobility and reductions in investment.

Altogether, the most-affected sectors account for 30-40% of total output in the EaP economies, while stringent containment measures remain in place. However, it is critical to note that this estimate does not take into consideration the speed or magnitude of policy responses, activity in other sectors of the economy, changes in the terms of trade, or any indirect/second-round effects of the drop in sectoral output. It also does not consider the role of sub-sectors that might not be negatively affected by the crisis and are prominent in some countries (e.g. gambling in Armenia).

Based on the assumption of complete or partial shutdowns in selected sectors, the immediate impact on any given economy for the duration of the shutdown is estimated to be between 20 and 30% of GDP depending on the structure of economy. For example, Georgia’s economy, which is mostly driven by the service sector, can be expected to contract by around 30%, while economies driven more by extractive (Azerbaijan) and manufacturing sectors (Ukraine) will be confronted with a smaller direct impact of containment measures. However, developments in external markets will add to the impact, particularly in Azerbaijan – the estimate above does not include the effects of lower oil prices.

Slowdown of global economic activity and its economic impact on EaP economies.

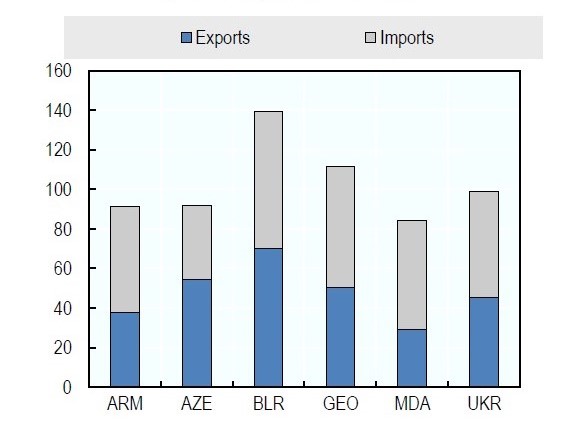

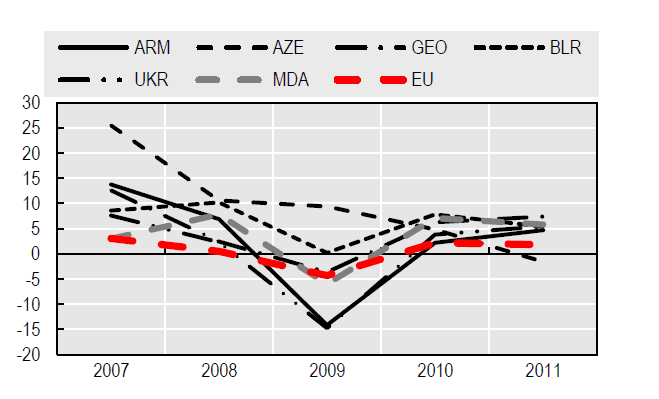

The impact of the pandemic on international trade will be severe, given partial or complete border closures, restrictions on the movement of goods, labour and even capital, a drop in global demand and disrupted value chains. The contraction of trade and other economic activity in major markets will directly affect smaller economies on the periphery. All EaP economies (except Ukraine) are very open (Figure 4), with small domestic markets and a high degree of exposure to macroeconomic trends in their main trading partners, the European Union and Russia. The experience of the 2009 economic crisis shows that a recession in the EU can result in an even sharper contraction in the EaP region, even if the domestic economic fundamentals are solid (Figure 5). Therefore, it can be expected that trade disruption and the anticipated recession in the EU and Russia will lead to an even larger reduction in economic activity in the EaP region. Moreover, FDI, which has been an important source of economic growth and production capacity building in the EaP in the last decade, is expected to decline by 30-40% in 2020 – 2021, constraining the region’s post-crisis recovery.

Trade openness of EaP countries – Exports & Imports on GDP, 2018

Source: World Bank, World Development Indicators

GDP growth in the EU and EaP in 2009

Note: YoY change in %

Source: World Bank, World Development Indicators

Domestic demand and investment in Armenia, Georgia, Moldova and Ukraine are significantly supported by personal remittances from abroad, equivalent to more than 10% of GDP. The anticipated economic contraction in the EU, Russia and the USA will most likely result in increased unemployment in these economies, which in turn might lead to reduced inflows of personal remittances to the EaP region. In addition, the Covid-19 crisis has also affected energy markets and has caused a sharp decrease in oil and gas prices. This will have implications in particular for Azerbaijan where the extractives sector generates around 35% of GDP and over 90% of exports.

While it is difficult to estimate the magnitude of the effect of the crisis on EaP economies and their SMEs, it is clear that this crisis will cause a sharp contraction in domestic output, household spending and international trade. The most-affected sectors account for 30-40 percent of total output in the EaP economies. Assuming a total or partial shutdown of their activity, Figure 1 shows the estimated impact of the containment measures on the output of EaP countries, while stringent containment measures remain in place.

Trade openness for EaP countries(2020-2021)

Source: World Bank Group, Fighting COVID-19 report